Unified Grocers Form 10-K Report

Document information

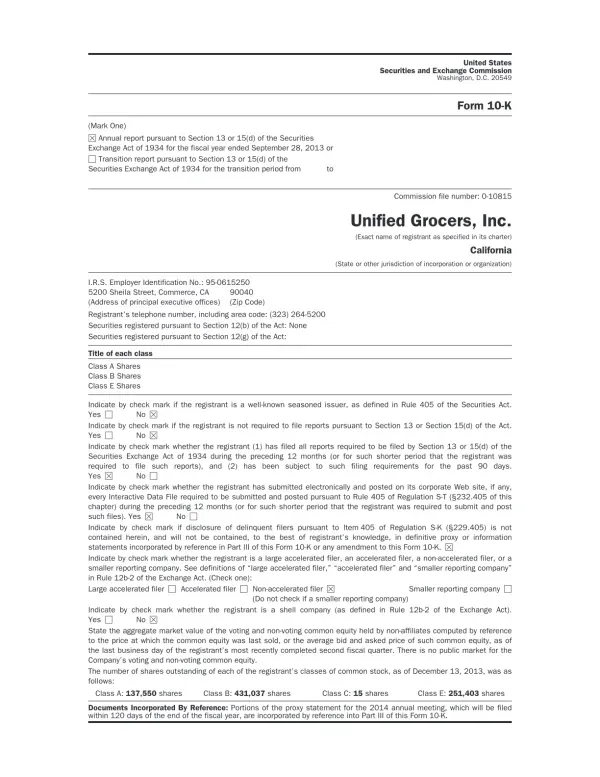

| Company | Unified Grocers, Inc. |

| Place | Washington, D.C. |

| Document type | Form 10-K Annual Report |

| Language | English |

| Format | |

| Size | 530.17 KB |

Summary

I.Business Overview Unified Grocers Wholesale Grocery Distribution

Unified Grocers, Inc. is a retailer-owned grocery wholesale cooperative serving supermarkets, specialty, and convenience stores primarily in the western United States and the Pacific Rim. The company sells a wide variety of supermarket supplies, including dry grocery, frozen foods, deli items, produce, bakery goods, and health and beauty care products. Unified also offers valuable retail support services such as merchandising, pricing, advertising, and technology solutions, plus insurance and financing services for its customers. The company operates in three distinct regions: Southern California, Northern California, and the Pacific Northwest. Unified's largest customer, Smart & Final, Inc., accounted for approximately 14% of total net sales in fiscal 2013, illustrating a concentration of sales amongst larger clients. The top ten customers accounted for 47% of total net sales in 2013, increasing from 42% in 2008. The company has seen a decline in membership since fiscal year 2008, falling from 520 to 389 members by the end of fiscal 2013. This is partly attributed to smaller retailers becoming Non-Members and consolidation within the industry. Unified's investment portfolio consists primarily of fixed-income securities, with approximately 86% held by insurance subsidiaries and 10% invested in Western Family Holding Company.

1. Company Profile and Structure

Unified Grocers, Inc., established in 1922 and incorporated in 1925, operates as a retailer-owned grocery wholesale cooperative. Its primary service area encompasses the western United States and the Pacific Rim, catering to supermarkets, specialty stores, and convenience stores. The company's extensive product portfolio mirrors a typical supermarket's offerings, including dry groceries, frozen foods, deli items, meat, produce, bakery goods, and health and beauty care products. Beyond product distribution, Unified Grocers provides essential support services to its clientele, encompassing merchandising, pricing strategies, advertising and promotional planning, technological solutions, equipment procurement, and real estate assistance. This comprehensive service provision is tailored to individual regional needs across the company's three main operational regions: Southern California, Northern California, and the Pacific Northwest. The document highlights a significant concentration of sales among larger customers; Smart & Final, Inc., a non-member customer, contributed approximately 14% of total net sales in fiscal 2013, and the top ten customers combined for 47% of net sales in 2013 (up from 42% in 2008). A notable decline in membership is also mentioned, with member count falling from 520 in 2008 to 389 by the end of fiscal year 2013. The company's significant investments (approximately 86%) are mainly in fixed-maturity securities and equity securities, held by its insurance subsidiaries to fund loss reserves. An additional 10% is invested in Western Family Holding Company (a private cooperative in Oregon) common stock, reflecting their relationship as a supplier of food and general merchandise. A further 4% of investments are held by other support businesses, primarily an investment in the National Consumer Cooperative Bank.

2. Investment Portfolio

The majority of Unified Grocers' investments (approximately 86%) are held within its insurance subsidiaries, primarily allocated to fixed-maturity and equity securities that support loss reserves. These investments include U.S. government agency obligations, high-grade corporate bonds, U.S. Treasury securities, and state/municipal securities. The remaining portion of the investment portfolio is largely distributed between the wholesale distribution segment (approximately 10%, primarily in Western Family Holding Company common stock) and other support businesses (approximately 4%, mainly an investment in National Consumer Cooperative Bank). The company also utilizes life insurance policies and publicly traded mutual funds to fund its Executive Salary Protection Plan and deferred compensation plan. The fair market value of these investments, excluding common equity securities held by the insurance subsidiaries, consistently exceeded their acquisition cost during fiscal year 2013. It is important to note the financial performance of these investments directly impacts Unified's overall operational outcomes. The stability of the company's financial position is reliant upon the success of this diversified investment strategy.

3. Mergers Acquisitions and Shareholder Structure

Unified Grocers' history includes a merger with United Grocers, Inc. in 1999 and the acquisition of certain assets and liabilities from Associated Grocers and its subsidiaries in 2007. The company's share structure involves different classes of shares (A, B, C, and E), each with unique characteristics and redemption terms. The Class B shares are central to the cooperative's member structure; members are required to hold a certain number of these shares based on their purchases. This requirement can be met through direct purchase or, in some cases, through patronage dividend distributions. The Class B Share Requirement is recalculated twice annually, and members may need to make subordinated deposits (Required Deposits) if their shareholdings fall short of the requirement. The Class E shares, issued as part of patronage dividends in previous years (2003-2009), have a stated value of $100 per share, are non-voting, and have a ten-year redemption restriction unless approved by the board or in case of company liquidation. The company also notes that its bylaws grant the board significant discretion in share redemptions for terminated members. In the second quarter of fiscal 2014, 6,509 Class B shares were to be redeemed, leaving 72,267 (17% of the outstanding Class B shares) still pending redemption, illustrating a trend of increasing redemption requests and a lower-than-allowed redemption rate. The redemption rate limitation is no more than 5% of outstanding Class B Shares annually. The company's capital shares and cash deposits are subject to contractual subordination in the event of insolvency.

II.Economic Factors Industry Trends Impacting Unified Grocers

Unified Grocers' performance is significantly impacted by economic conditions and evolving consumer preferences. The recent economic downturn and subsequent recovery led to fluctuating consumer spending and price sensitivity. The growing demand for natural and organic products showcases a shift towards higher-quality options. Consumers increasingly shop at multiple stores for better value and selection, impacting full-service grocery stores. Government assistance programs like SNAP and WIC also directly affect consumer spending on grocery products. Inflationary pressures significantly impact Unified's operations, affecting sales, costs of goods sold, employee wages, and energy expenses. The company employs strategies to pass on cost increases to customers; however, delays in price adjustments can affect profitability. Intense competition exists with vertically integrated chains (Albertson's, Kroger, Safeway, Trader Joe's, WinCo Foods), warehouse clubs (Costco, Sam's Club, Walmart), discount stores (Target, CVS), and specialty retailers (Sprouts, Whole Foods). The proliferation of discount stores and supercenters is a major challenge to Unified's customers and consequently, impacts Unified's sales and earnings.

1. Macroeconomic Influences and Consumer Behavior

Unified Grocers, along with the broader grocery industry, is significantly impacted by prevailing economic conditions. Factors such as consumer confidence, employment rates, and shifts in consumer tastes and purchasing patterns play a crucial role. The recent economic downturn resulted in heightened price sensitivity among consumers, leading them to favor more budget-friendly grocery options. This trend persists in some markets, particularly within several Hispanic communities. Conversely, other markets experienced a reversal, with consumers showing a greater willingness to spend on higher-priced, premium products. This shift is exemplified by the industry's notable surge in natural and organic product sales. The text emphasizes the growing tendency for consumers to diversify their shopping habits, utilizing multiple stores with varying formats to maximize selection and value. This behavior has favored discount and alternative format stores. Finally, the level of government spending which supports grocery purchases – notably through programs like SNAP (Supplemental Nutrition Assistance Program) and WIC (Special Supplemental Nutrition Program for Women, Infants, and Children) – has a profound impact on overall consumer spending in this sector. The temporary payroll tax holiday (expired in 2012) is also cited as a factor influencing consumer spending.

2. Inflationary Pressures and Commodity Costs

Inflationary pressures across various aspects of Unified Grocers' operations are highlighted as a key concern. These pressures affect sales, cost of sales, employee wages and benefits, workers' compensation insurance, and energy and fuel costs. The company experiences significant price volatility in specific commodities, ingredients used for manufactured breads and processed fluid milk, and packaged goods sourced from external manufacturers. While Unified's operational flexibility is designed to allow for passing these increased costs onto customers, there's a risk that such increases may not be implemented promptly, resulting in incomplete cost recovery. Furthermore, the effect of potential future cost decreases is difficult to predict accurately. Any decrease in purchased or manufactured product costs may require lowering selling prices to remain competitive, affecting profitability. The company also notes its vulnerability to energy cost changes (excluding fuel) and that while it applies a fuel surcharge on product shipments to mitigate fuel price volatility, this surcharge is indexed and may not fully cover extreme fluctuations.

3. Competitive Landscape and Market Share

Unified Grocers' customers compete in a dynamic and challenging marketplace characterized by intense competition. Their direct competitors include significant, vertically integrated regional and national chains such as Albertson's LLC, Kroger Co. (including Ralphs and Food 4 Less), Safeway Inc. (including Vons and Pavilions), Trader Joe's Company, and WinCo Foods, all operating traditional full-service grocery stores. They also face competition from warehouse club stores and supercenters (Costco, Sam's Club, Walmart), discount and drug stores (CVS, Target, dollar stores), specialty retailers focusing on upscale and natural/organic products (Sprouts, Whole Foods), and various convenience stores. The document highlights the evolving competitive landscape, noting the expansion of discount stores, supercenters, and warehouse clubs, and the increasing efforts of non-traditional formats to expand product offerings to compete more directly with traditional full-service grocery stores. The competitive pressures from these large, well-resourced players with established brand recognition and economies of scale pose a significant challenge, especially concerning the sale of non-perishable products, which tend to have higher profit margins for Unified. This increased competition is pushing traditional grocery stores, Unified's customers, to expand perishable product offerings, which generally yield lower margins.

III.Unified Grocers Competitive Strategy Share Structure

Unified Grocers' strategy centers around equipping its customers with the resources needed for retail success. This includes offering a broad range of high-quality products and services at competitive prices, adapting to changing consumer demands and technological advancements, and expanding into new geographic areas and service offerings (logistics, warehousing). The company's shares (Class A, B, C, and E) have a complex structure, with Class A and B shares exchanged with members at an Exchange Value Per Share calculated based on book value and retained earnings (excluding non-allocated retained earnings). The redemption of shares is subject to various limitations, including a 5% annual limit on Class B share redemptions. Class E shares have a stated value of $100 per share and are subject to specific transfer and redemption rules. Unified's share structure and redemption policy are subject to California General Corporation Law.

1. Competitive Strategy Empowering Retail Success

Unified Grocers' core competitive strategy focuses on providing its retail customers with the necessary tools and resources to thrive in the marketplace. The company prioritizes offering a comprehensive range of high-quality products and services at competitive prices, enabling its customers to attract and retain consumers. Recognizing the dynamic nature of the retail landscape and the evolving consumer demands, Unified aims to remain at the forefront of innovation, supplying new products and services to its customers. This proactive approach is intended to help its customers capitalize on emerging market opportunities. Beyond its traditional supermarket channels, Unified seeks to expand its reach by increasing sales outside of these channels, venturing into new geographic regions through potential partnerships with other regional wholesale distributors, and exploring opportunities to leverage its existing assets in logistics, warehousing, and transportation services. This multifaceted strategy positions Unified as a comprehensive partner for its customer base, moving beyond simple product supply to comprehensive business support.

2. Share Structure and Exchange Value Per Share

Unified Grocers operates with a complex share structure featuring Class A, B, C, and E shares. The Exchange Value Per Share, used for exchanging Class A and B shares with members, isn't directly reflective of the net asset value. This value is impacted by board decisions regarding retained earnings from the Non-Patronage Business. If the board retains a portion of these earnings and doesn't allocate them to the Exchange Value Per Share, the repurchase price of Class A and B shares will be reduced in the current and subsequent years. Conversely, reversing prior allocations of earnings from the Non-Patronage Business to the Exchange Value Per Share will increase the repurchase price. Class C and E shares are exchanged with directors and members, respectively, at fixed stated values. The board retains the authority to annually modify the non-allocated retained earnings excluded from the Exchange Value Per Share calculation; the amount was reported as $6.9 million in fiscal years 2011, 2012, and 2013. The calculation itself is defined as the Book Value (defined as the fiscal year-end balance of Class A and B shares, excluding the redemption value of unredeemed shares tendered for redemption, plus retained earnings excluding non-allocated retained earnings) divided by the number of Class A and B shares outstanding at the end of the fiscal year, excluding shares tendered for redemption.

3. Class B and Class E Share Requirements and Redemption

The document details the requirements for Class B shares, essential for Unified Grocers' members. The Class B Share Requirement is determined twice yearly, based on member purchases over the preceding four quarters. If, after accounting for patronage dividends, a member's shareholding falls short, a subordinated deposit (Required Deposit) is typically required, potentially payable over 26 weeks. Further purchases are needed if the requirement is still not met after the fourth fiscal quarter. The board maintains the discretion to adjust this requirement. Former shareholders of United Grocers, Inc., or Associated Grocers, Incorporated may elect to meet their Class B Share Requirement solely through patronage dividend distributions under specific conditions. Class E shares were issued as a portion of patronage dividends from 2003-2009, and their future issuance is at the board's discretion. They are non-voting, have a $100 stated value, and are transferable only with the company’s consent, primarily restricted to transfers related to business transitions. They become eligible for redemption ten years after issuance, with outstanding shares eligible for redemption between the end of fiscal 2013 and fiscal 2018, subject to further limitations under California General Corporation Law, credit agreements, the company's articles of incorporation and bylaws, its redemption policy, and board approval.

IV.Financial Performance and Risks

Unified Grocers experienced a net loss of $17.6 million in fiscal 2013, compared to a net earnings of $2.0 million in 2012. The decrease was primarily due to charges related to early debt extinguishment, increased workers' compensation reserves, transition costs, lower net sales, a shift in sales mix toward lower-margin products, and decreased inventory holding gains. A significant factor was the loss of a major customer in 2011 resulting in an $87.2 million sales decline. The company faces financial risks related to its concentrated customer base, the ability to pass on cost increases, the adequacy of its insurance reserves, and its reliance on cash flow from operations and member investments. The company also faces risks associated with potential system failures, adverse weather events, and changes in accounting guidance. The company utilizes a revolving credit facility and term loan to support its daily operating activities and mitigate financial risks.

1. Fiscal Year 2013 Financial Results and Analysis

Unified Grocers reported a net loss of $17.6 million for fiscal year 2013, a significant decrease from the $2.0 million net earnings in 2012. This substantial decline, representing 0.6% of total net sales, is attributed to several key factors. Charges related to early debt extinguishment and increased workers' compensation reserves contributed to the loss. Transition costs associated with consolidating the Fresno dry warehouse facility into Southern and Northern California locations also played a role. Lower net sales, a shift in sales mix towards lower-margin products (a decrease in sales of non-perishable products, which have higher margins than perishable products), and reduced inventory holding gains all negatively impacted earnings. The decrease in inventory holding gains was linked to lower food price inflation in 2013 compared to 2012. While lower employee pension and postretirement benefit expenses and a one-time employee postretirement benefit plan curtailment gain partially offset these negative factors, the overall result was a substantial net loss. The company anticipates similar market conditions in the following fiscal year. A significant sales decrease of $69.6 million is specifically highlighted, resulting from lost customers and store closures. The company also notes a change in its sales presentation regarding vendor direct arrangements, conforming to ASC 605-45-45. This resulted in lower reported net sales, while a 'gross billing' metric, which adds back vendor direct arrangements, shows a decrease of 1.4% compared to a 1.9% decrease in net sales.

2. Financial Risks and Resource Management

Unified Grocers highlights several key financial risks. The company's increasingly concentrated customer base, with the top ten customers accounting for 47% of net sales in 2013, creates a risk of significant financial impact from the loss of a major client. The loss of a top-ten customer in the third quarter of fiscal 2011 resulted in an $87.2 million loss in annual net sales. The company's ability to maintain or increase sales to its customers is crucial to its financial performance. The document also notes the potential for reduced sales and earnings if its members continue to lose market share to larger competitors with more significant financial resources. Maintaining profitability is further challenged by inflationary pressures on various operational expenses and the difficulty in passing on cost increases to customers in a highly competitive market. The company's financial resources primarily rely on cash flow from operations and member investments. If these sources prove insufficient, the company intends to utilize its credit facilities, which are subject to various covenants, including fixed charge coverage and debt-to-capital ratios. While currently compliant with all covenants, there is no guarantee of future compliance. The company acknowledges the potential for financial impacts due to system failures, natural disasters, and changes in accounting standards, impacting its share value and patronage dividends.

3. Insurance Segment Performance and Risks

The Insurance segment's cost of sales, primarily consisting of claims losses, loss adjustment expenses, underwriting expenses, commissions, and regulatory fees, increased significantly in the 2013 period. The increase of $11.6 million to $19.8 million from $8.2 million in 2012 is primarily due to increased claims development for workers' compensation policies. This includes additional development from a high-deductible loss portfolio and new policies. The adequacy of insurance loss reserves relies on actuarial estimates based on healthcare cost trends, claims history, demographics, and industry trends; consequently, the amount of loss reserves and future expenses is significantly affected by these variables and may significantly change. The document emphasizes that the company's cost of insurance and the adequacy of its loss reserves are inherently uncertain, and unexpected losses could materially impact financial results.